Welcome to RC Dave Group

Phone: +91 9624898242

Email: info@rcdavegroup.com

Private Limited (PVT LTD) Company Registration in India

- Affordable & Transparent: Registration starting at ₹999 + Govt Fee with no hidden charges.

- Comprehensive Compliance: SPICe-INC-32, eMoA-INC-33, eAOA-INC-34 filings, DSC, PAN, and TAN—all handled seamlessly.

- Post-Incorporation Benefits: Includes free MSME registration, GST filing support, and banking setup.

- Trusted by Startups: Rated #1 for Pvt Ltd Registration, with 100% MCA-compliant filings.

PVT LTD COMPANY REGISTRATION: STEP BY STEP GUIDE

- Registering a Private Limited Company is a top choice for entrepreneurs in India, thanks to its legal recognition, limited liability protection for directors, and strong market credibility. RC DAVE GROUP makes the entire registration process seamless—guiding you through every essential step, from required documents and costs to key benefits—while also answering all your frequently asked questions.

DOCUMENTS REQUIRED FOR COMPANY REGISTRATION

- Passport-sized Photographs of the directors.

- Identity Proof of Directors and Shareholders: PAN card for Indian nationals and passport for foreign nationals.

- Address Proof: Aadhar card, voter ID, passport, or driving license.

- Residential Proof: Recent utility bills or bank statements.

- Registered Office Proof: Rent agreement and NOC from the landlord if rented, or ownership documents if owned.

What Is a Private Limited Company?

- A private limited company (commonly abbreviated as Pvt Ltd) is considered a separate legal entity from its owners, offering a secure framework for operations while safeguarding the personal assets of its members. This business structure, governed by the Companies Act, 2013, is popular among entrepreneurs and small to medium-sized businesses (SMEs) for its combination of limited liability protection, ownership control, and scalability. For instance, startups like Swiggy began as private limited companies due to their ability to secure venture capital funding while maintaining limited liability for founders. Unlike public companies, a private limited company restricts the transfer of shares and operates with a focused group of stakeholders. This makes it ideal for businesses seeking operational independence, confidentiality, and long-term growth.

Minimum Requirement

- Minimum 2 Shareholders

- One of the Directors must be Indian Resident

- DSC (Digital Signature Certificate) for 2 Promoters & 1 witness

- Minimum 2 Directors

- Suggested Authorised Share Capital 20,000 INR

- The directors and shareholders can be same person

- DIN (Director Identification Number) for all Directors

What All You Get

- DIN for 2 Directors

- Customized Incorporation Master File

- Bank Account Opening Support

- MOA + AOA

- Digital Signature Token for 2 Promoters & 1 witness

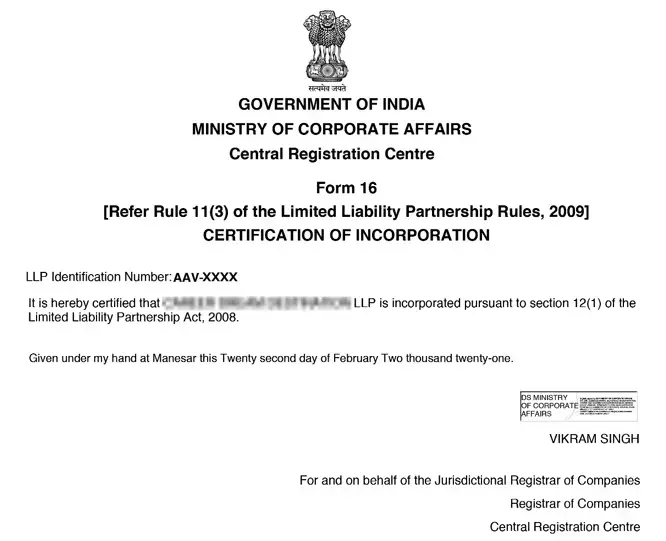

- Incorporation Certificate

- Company PAN Card

- Company Name

- Company TAN/TDS

- PF + ESIC + Professional Tax

BENEFITS OF COMPANY REGISTRATION

Limited Liability Protection to Directors personal assets

Startups often need to borrow funds or purchase on credit. In a traditional partnership, if the business fails to repay its debts, the personal savings and assets of the partners are at risk.

Better image and credibility in Market

Private limited company is popular and well known business structure. Corporate Customers, Vendors and Govt. Agencies prefer to deal with Private Limited Company instead of proprietorship or normal partnerships.

Easy to raise funds and loans

Pvt. Ltd. company enjoys wide options to raise funds through bank loans, Angel Investors, Venture Capitalists, in comparison to LLPs and OPCs.

Favorite Business structure for Investors

Investors love to invest in Private Limited companies as it is well structured and less strings attached. Most important it is very easy to exit from a private limited company.

Easy to attract Employees

For startups putting together a team and keeping them for long time is a challenge, due to confidence attached to private limited structure.

Easy to raise funds and loans

Private Ltd. is easy to sell, very less documentation and cost is involved in selling a Pvt. Ltd. company.

FAQs on Private Limited Company Registration

To help you get started with confidence, we've compiled answers to the most frequently asked questions about Private Limited Company registration. These FAQs will give you clear insights into every step and empower you to take the first step toward building your business.

A Private Limited Company requires a minimum of two directors, two shareholders, and one Indian resident director, as per the Companies Act, 2013.

Yes, a Private Limited Company can operate multiple businesses, provided all activities are listed in the Memorandum of Association (MoA) and approved by the Registrar of Companies (RoC).

- For Directors and Shareholders: PAN card, Aadhaar/Passport, and address proof (utility bill or bank statement).

- For the Company: Digital Signature Certificate (DSC), MoA, AoA, and registered office proof.

- For Corporate Shareholders: Board resolution and incorporation certificate.

Yes, a residential address can be used as the registered office during incorporation, but it will be used for all official communications.

The entire process typically takes 10 to 15 working days, subject to MCA approval and document accuracy.

- Open a current account for the business.

- File Form INC-20A for the Certificate of Commencement.

- Appoint an auditor within 30 days.

- Adhere to annual compliance requirements like filings and board meetings.

- Submit accurate and complete documentation.

- Choose a unique and MCA-compliant name.

- File forms like SPICe+ within the specified timelines.

On Time Service

Secure Online Payment

100% Satisfaction

No Hidden Charges

Experienced Professionals