Welcome to RC Dave Group

Phone: +91 9624898242

Email: info@rcdavegroup.com

Udyam/MSME New/ Re Registration Document List

Limited Liability Partnership (LLP) is one of the preferred form of business structure among entrepreneurs due to its compliance flexibility. RC Dave Group Takes you through the process of registering an LLP, covering key steps, required documents, costs, benefits, and handling all your frequently asked questions. We’ll also discuss the differences between LLP and other forms of business entities like Pvt. Ltd., OPC, and traditional partnerships.

LLP REGISTRATION: STEP BY STEP GUIDE

- Prior to initiating the LLP registration procedure it is crucial to comprehend the benefits that an LLP offers to its partners. An LLP merges the features of a partnership and a company granting its partners the benefits of limited liability along with the flexibility of a partnership structure.

DOCUMENTS REQUIRED FOR LLP REGISTRATION

- Partner's PAN Card: For identity verification.

- Address Proof of Partners: Aadhar Card, Voter ID, etc.

- Registered Office Proof: Electricity bill/water bill of the proposed registered office.

- No Objection Certificate (NOC): If rented, NOC from the owner of the registered office premises

- Passport-size Photographs of the partners

What Is a LLP Company?

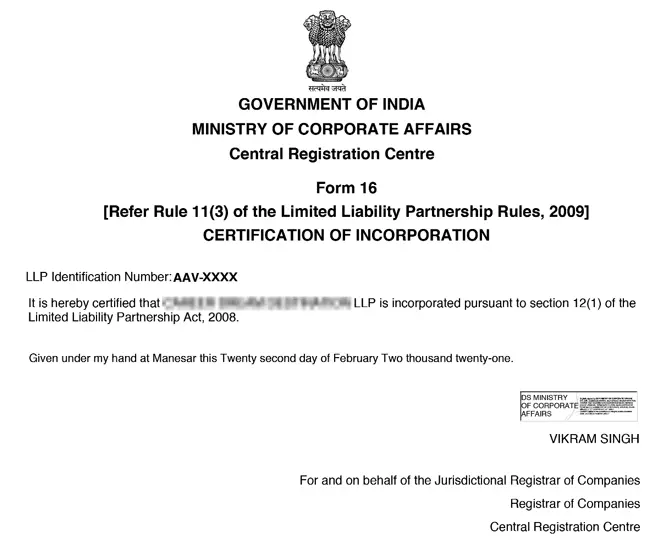

- In India, the concept of Limited Liability Partnership was introduced in 2008 by the LLP Act, 2008. In India, LLP has become the most preferred form of business among entrepreneurs. Registering an LLP in India has both the limited liability features of a Private Company and the flexibility of a Partnership Firm. No partner is answerable on account of unauthorized or illegal actions of other partners, thus individual partners are protected from joint liability created by another partner’s wrongdoing. LLP is generally preferred by professionals, Micro & Small businesses that are family owned or closely held. In 2022, the MCA (Ministry of Corporate Affairs) introduced LLP (Second Amendment) Rules, 2022 and it has made the procedure of LLP Registration even easier & transparent as now all the LLP Forms will be digital-based forms. Also, with the LLP (Second Amendment) Rules, 2022, Limited Liability Partnerships shall be allotted their TAN & PAN along with the Certificate of Incorporation itself.

Minimum Requirement

- Minimum 2 Partners

- DIN (Director Identification Number) for all the Designated Partners

- If a body corporate is a Partner, it has to nominate a natural person as its Nominee

- DSC (Digital Signature Certificate) for all the Designated Partners

- There is no concept of share capital, but each Partner has to contribute towards capital of LLP

- Address proof for office of LLP

What All You Get

- DIN for 2 Partners

- Digital Signature for 1 Partner

- Incorporation Certificate

- LLP PAN Card

- LLP TAN/TDS

- Bank A/C Opening Support

- Master File of all docs filed for Incorporation

- LLP Agreement

BENEFITS OF LLP REGISTRATION

Limited Liability Protection to Directors personal assets

Startups often need to borrow funds or purchase on credit. In a traditional partnership, if the business fails to repay its debts, the personal savings and assets of the partners are at risk.

Better image and credibility in Market

Private limited company is popular and well known business structure. Corporate Customers, Vendors and Govt. Agencies prefer to deal with Private Limited Company instead of proprietorship or normal partnerships.

No Audit Requirement & Minimal Compliances

LLP is easy to manage and statutory audit is not required for Limited Liability Partnership. LLP is most ideal for small enterprises. Tax Audit is also not required for LLPs with capital less than Rs. 25 lac and turnover not exceeding Rs. 40 lac.

Continuity of Business

LLP continues to exist beyond the existence of its Partners. This is not possible in traditional partnership firms.

FAQs on LLP Registration

To register for the LLP, you may follow the given steps: apply for the DSC < apply for the DIN < draft the LLP Agreement for the partners to sign it < Fill Form-2, Form-3, and Form-4 along with attaching the LLP agreement < pay the LLP registration fee < application verification process will take place < once verified, you will receive the certificate for incorporation.

Individual eligible to conduct business in Indian Region is eligible for LLP registration if that individual is accompanied by another eligible partner with Indian Citizenship

It is one of the eight forms of company structures available for business registration under Companies Act 2013. It stands for Limited Liability Partnership.

LLP is not allowed to raise equity investment which eventually narrow down the capital investment options. Moreover, the income tax rate is bit higher for the LLP in comparison to that of a private limited company.

You may proceed ahead with LLP registration owing to its wide range of benefits such as no capital requirement, minimum two directors, less registration cost, less complex process, etc.

LLP is a private entity which is regulated under the Companies Act 2013.

There is no minimum capital requirement for LLP registration, meaning that the LLP can be registered at capital contribution.

On Time Service

Secure Online Payment

100% Satisfaction

No Hidden Charges

Experienced Professionals